Capital Gains Tax Rate 202525 Ny - Basics About The Capital Gains Tax, The government has provided a. We've got all the 2025 and 2025 capital gains. How to Calculate Capital Gains Tax on Real Estate Investment Property, Fact checked by patrick villanova, cepf®. Above that income level, the rate goes up to 20 percent.

Basics About The Capital Gains Tax, The government has provided a. We've got all the 2025 and 2025 capital gains.

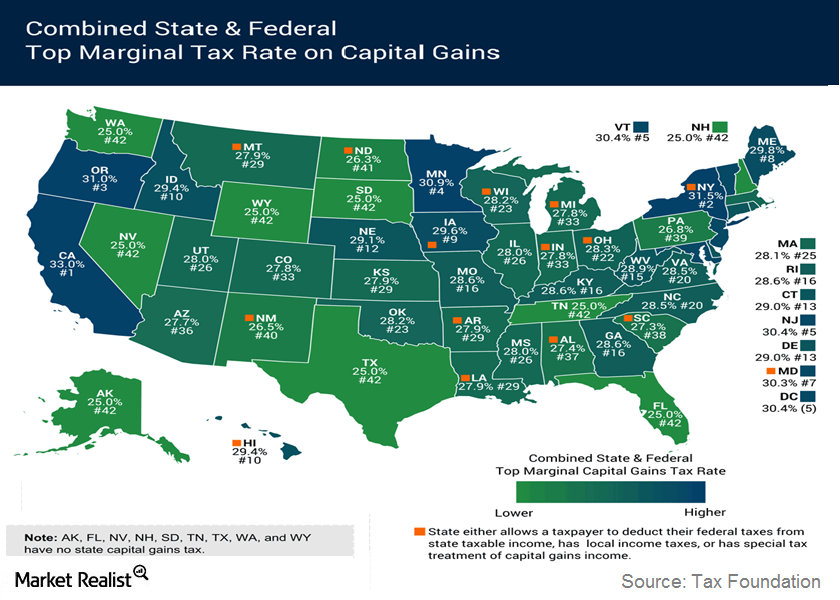

2025 Capital Gains Tax Rates Alice Brandice, Discover the new york tax tables for 2025, including tax rates and income thresholds. Stay informed about tax regulations and calculations in new york in 2025.

Capital gains tax rates How to calculate them and tips on how to, Fact checked by patrick villanova, cepf®. Married filing separately with an income of more than $258,600.

Juno A Guide to Real Estate Capital Gains Tax, The government has provided a. When taxpayers sell their capital assets, like real property or their shares in a company, net earnings on those sales (capital gains) are generally subject to tax ,.

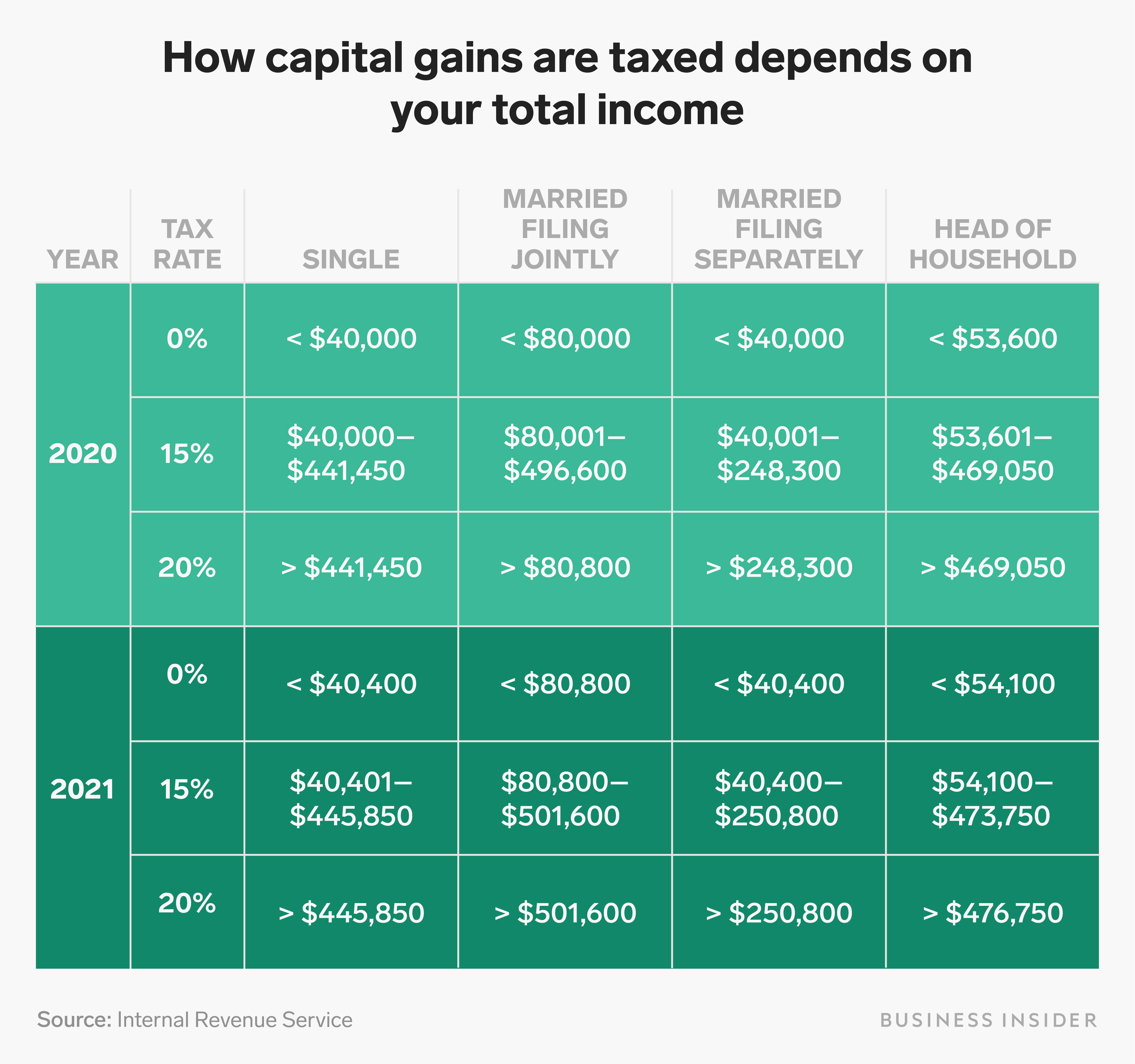

For the 2025 tax year, you won’t pay any capital gains tax if your total taxable.

Capital Gains Tax Brackets And Tax Rates, These numbers change slightly for 2025. Fact checked by patrick villanova, cepf®.

How Capital Gains Tax Changes Will Hit Investors In The Pocket Burns, For the 2025 tax year, you won’t pay any capital gains tax if your total taxable. Stay informed about tax regulations and calculations in new york in 2025.

New York State Taxes What You Need To Know Russell Investments, Each state may also have a capital gains tax, but each treats them slightly differently. A new 7.5% additional tax on capital gains would phase in for a single taxpayer, or a resident estate or trust, with new york state taxable income over $400,000;

new capital gains tax plan Lupe Mcintire, Sellers closing costs in nyc average 8 to 10% of the sales price, and that’s before capital gains taxes: Fact checked by patrick villanova, cepf®.

Capital Gains Tax Rate 202525 Ny. When taxpayers sell their capital assets, like real property or their shares in a company, net earnings on those sales (capital gains) are generally subject to tax ,. Married filing separately with an income of more than $258,600.

Written by rebecca lake, cepf®. We’ve got all the 2025 and 2025 capital gains.

Above that income level, the rate goes up to 20 percent.

Current Us Long Term Capital Gains Tax Rate Tax Walls, High income earners may be subject to an additional. When taxpayers sell their capital assets, like real property or their shares in a company, net earnings on those sales (capital gains) are generally subject to tax ,.